60+ your mortgage statement should always come from your lender

Web Mortgage statements are documents from your lender that provide you with information about your loan. You ll break even on the.

Free 9 Mortgage Statement Samples And Templates In Pdf

So the funds should show up on the two months bank statements youre.

. You have a current mortgage at 5 and have been approved for a new mortgage at 375. You can get free weekly credit reports from each. Web A mortgage application is submitted to a lender when you apply for a loan and includes information that determines whether the loan will be approved.

Web A mortgage company or lender uses a proof of deposit to determine if the borrower has saved enough money for the down payment on the home theyre looking to. Web If your loan is sold to a new lender. Expect to receive a separate notice from the new lender.

Web A mortgage statement is a document detailing the information of your loan. They are useful for staying up-to-date with your. It typically is sent every month and includes how much you owe.

Web Mortgage Statement as Documentation. Web A closing disclosure is a five-page form that federal law requires lenders to complete and give to borrowers before closing. This is due to you within 30 days of them taking ownership of the loan.

Web Seasoned typically means the money has been in your account for at least 60 days. Web The lender is the company that you borrow the money from typically a bank credit union or mortgage company. Web Document interest paid with your annual mortgage statement Lenders are required by the IRS to send out a Form 1098 to most customers who have paid more than 600 in.

The best scenario for refinancing. Web You also should check your credit report after 30 to 60 days to make sure it shows your mortgage was paid off. If a borrower is considering selling the property or considering refinancing with another lender a current mortgage statement is nearly.

Web Now comes the mortgage statement a document that comes from your mortgage loan servicer. When you get a mortgage loan you sign a contract and agree to. You will receive a mortgage statement every billing cycle.

The form puts the loans key. Web A payoff statement is a document that shows how much money a borrower will need to submit to their lender to fully pay off or satisfy a mortgage or other loan.

Best Payday Loans For Emergencies Unexpected Bills And More

First Mortgage Loans Certified Federal Credit Union

The Small Mistakes That Will Cost You Your Mortgage Expert Advice Express Co Uk

Your Mortgage Statement Explained

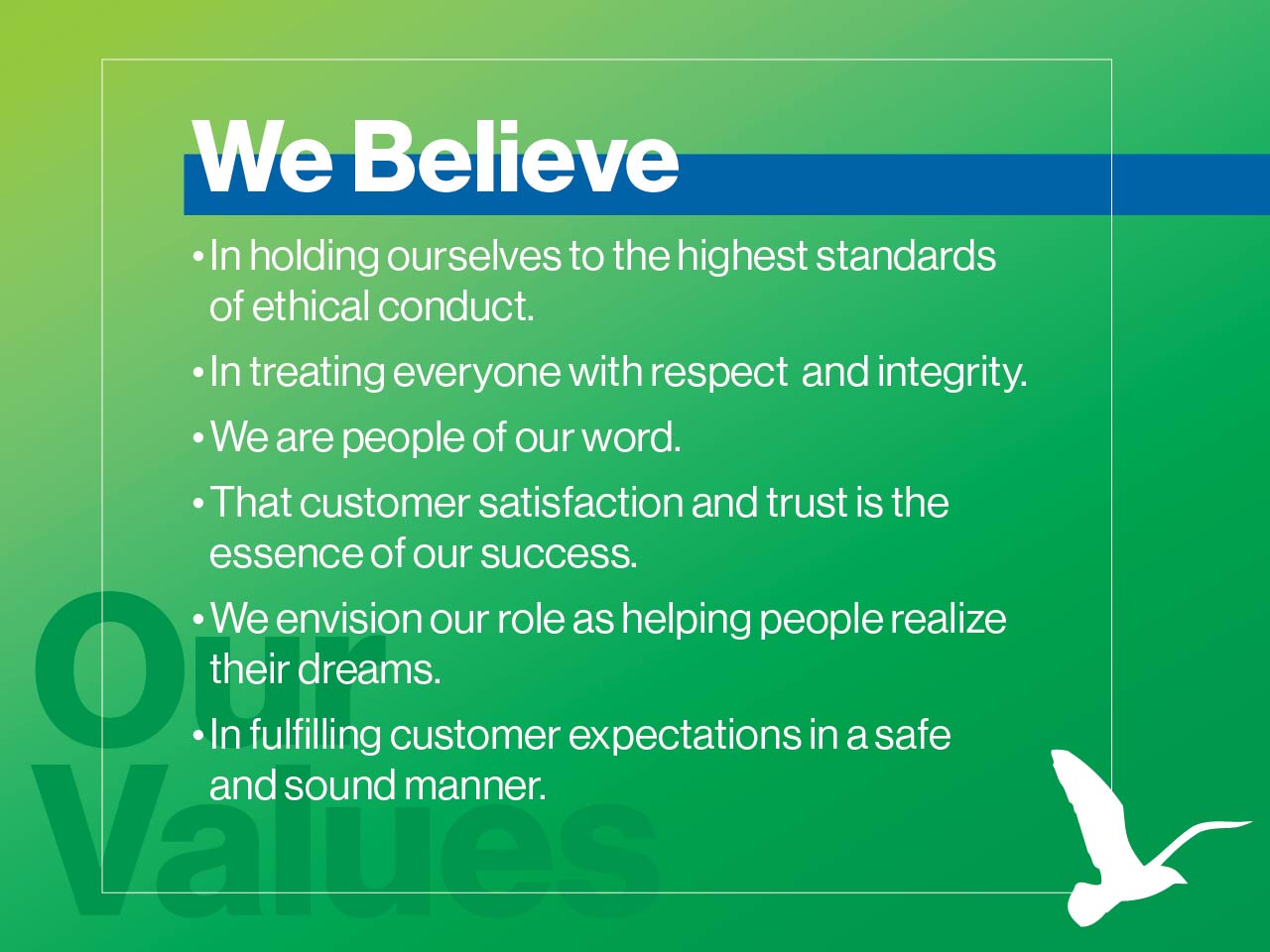

Vision Mission Values North Shore Bank

Federal Register Amendments To The 2013 Mortgage Rules Under The Real Estate Settlement Procedures Act Regulation X And The Truth In Lending Act Regulation Z

Should I Overpay My Mortgage Moneysavingexpert

Federal Register Amendments To The 2013 Mortgage Rules Under The Real Estate Settlement Procedures Act Regulation X And The Truth In Lending Act Regulation Z

How To Close More Mortgage Loans 15 Mortgage Sales Tips

Beginner S Guide How To Get A Mortgage In Germany

American Express Cardholders 2 000 6 000 For Purchasing Refinancing Mortgage With Better Com Doctor Of Credit

What Is Mortgage Delinquency Rocket Mortgage

How To Read Your Mortgage Documents And Not Get Screwed

60 Ltv Mortgages Our Best Rates

What Does Your Mortgage Payment Really Include

Cmp 16 08 By Key Media Issuu

60 Mortgage Marketing Ideas To Fill Your Pipeline In 2023 Kaleidico